Saving money can be difficult, especially if you are on a tight budget. Sometimes it helps to think of creative and easy ways to save money. Here are some ways to save that are so easy that you won’t even think about it.

This post may contain affiliate links. If you make a purchase through one of these links I may earn a small commission at no additional cost to you. Please see my full disclosure policy for details.

Open a separate savings account

Most of us have both a checking and a savings account with our bank. It is very easy to transfer funds from your checking account to your savings account, but your savings account funds are probably still easily accessible. If you are trying to build up some savings, I recommend having a separate online savings account.

There are a few different credit card companies or online banking services that have the online bank account option. Some even pay interest, which is an added bonus. The easiest way to start saving money is to set up an automatic transfer from your regular bank account to your online savings account. You can set it up to have money transferred once a month, twice a month, or even once a week. The amount you have transferred is totally up to you. It can be as little as $20 a month, but it will slowly add up over time. You are able to make withdrawals from this account, but you may only be allowed to make a few withdrawals per month. Remember, this is a savings account so that is a good thing.

The online savings account that I use is www.capitalone.com. A Capital One online savings account is easy to set up and use, and you don’t have to have a credit card through them. It’s also an interest paying account so that’s an added bonus. I have a small automatic transfer to this account set up for once a month. Whenever we have a little extra money to spare, I transfer it over to this account.

Start a money jar

Another old school way of saving money is putting extra cash in a jar or an empty coffee can. Remember doing that growing up when you wanted to save up for something? This is the grown up way of having a piggy bank.

Several years ago my mom and I wanted to go on a girls trip to Hawaii before I got married. I was busy saving all my extra money for my wedding, but we knew this might be the last chance we’d have in a long time to take this trip. Several months before the trip, my mom made me this savings can with how much money I would need to put in the can each week. She put the date and the amount I needed to put in each time to reach my goal. Over the months it all added up, and when the time came I had enough money to pay for my trip. You can use the savings jar idea to save for pretty much anything. A new car, a vacation, some new furniture, or whatever your heart desires.

There are different and creative ways to save and put money in your savings jar too. If you like to buy coffee drinks from your favorite coffee stand, you could try making your own coffee drinks at home a few times a week instead. Every time you normally would stop by the coffee stand, put $5 into your savings jar. It adds up pretty fast!

There are several different cute savings jars like this one that you can get to help motivate you to start saving your cash.

Cash-only envelope system

Speaking of cash, another old-school, but powerful way to save money is to use the cash-only envelope system. The way you do this is: assign physical envelopes for spending categories (e.g., groceries, gas, fun, etc.). Once all the cash is gone, that’s it. It creates immediate awareness of spending limits and keeps you from overspending.

This handy little budget binder has everything you need to start your cash-only system and help you stay organized with envelopes and labels.

Sell your stuff

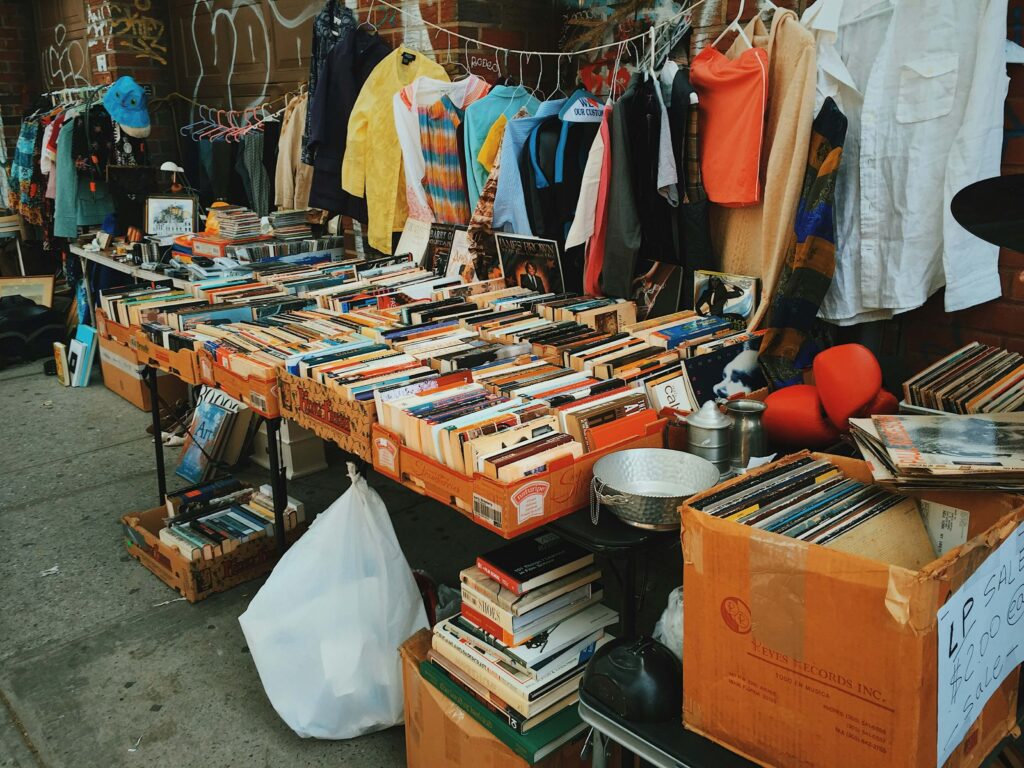

Another way I put money in my savings jar is by selling things I don’t need anymore on local swap and sell sites. There are probably some for your local area on Facebook, or you can also sell your items on sites like Ebay or OfferUp. I sell my children’s clothing that they’ve outgrown and household items I don’t need anymore. Any money I make from selling my items goes into my savings jar.

Use cash back or points apps

There are many apps out there that will give you cash back or points just for taking a picture of your receipt after you go shopping. This is a great way to earn money on things that you already buy like gas and groceries. There are a few of these types of apps I use. Every time I come home from grocery shopping, I upload my receipts to the apps and sit back and watch my points grow. I save my points up all year and transfer them to Amazon gift cards to use on Christmas presents. These are the receipt apps that I use:

- Fetch – use code G7WVQ to get a bonus when you submit your first receipt.

- Receipt Pal

- Receipt Hog – use code rat10811 to get a bonus when you submit your first receipt.

- Coin Out – use code 7Z9HFE7 to get a bonus when you submit your first receipt.

- Upside – this app is for cash back on purchases at restaurants and gas stations. We usually get at least a few dollars back in the app each time we fill up at a gas station that’s offered with Upside. Use referral code 7AJA5 to get an extra 15% cash back on your first purchase.

Turn hobbies into income

Love baking, crafting, writing, or photography? Start small – sell cookies at local markets, list crafts on Etsy, or offer freelance services. This lets you save without cutting back – by earning more from what you enjoy. I love making specialty coffee drinks for myself and other people. Every year, I join a local bazaar and have a booth set up where I sell coffee drinks. It’s a great way to make some extra cash and it helps pay for some of our Christmas expenses.

Do a no-spend challenge

A “no-spend challenge” is where you pick a weekend, week, or a whole month where you spend money on only essentials – no dining out, no impulse buys, no entertainment costs. The most popular and effective way to do it is to have a no-spend month. It’s a great reset that reveals how much unnecessary spending happens daily. When you do this challenge, you will be surprised to find out what is actually a need and what is just a want. If you do the no-spend challenge for an entire month, you will probably have a pretty decent amount of money left in your bank account at the end of the month.

Host swap events with friends

Instead of shopping, host a clothing, book, or home decor swap with friends or neighbors. It’s a fun, social way to refresh your wardrobe or home – for free! As they say, “one man’s trash is another man’s treasure”. 🙂

See how creative you can get with saving your money and watch your savings grow. Challenge yourself and make it fun!

Related posts:

Needs vs. Wants: How to cut back and save on the extras